您现在的位置是:Fxscam News > Exchange Dealers

EU Economic Commissioner says progress made in trade talks with the United States

Fxscam News2025-07-22 12:48:56【Exchange Dealers】2人已围观

简介The latest fraud cases of foreign exchange platforms,China's regular foreign exchange trading platform rankings,Intensive Negotiations Between Both Parties as Tariff 'Cliff' ApproachesValdis Dombrovskis

Intensive Negotiations Between Both Parties as Tariff 'Cliff' Approaches

Valdis Dombrovskis,The latest fraud cases of foreign exchange platforms the EU Commissioner for Economic Affairs, stated after attending the Eurozone finance minister meeting in Luxembourg this Thursday that trade talks between the EU and the US are in an "intensive" phase and are progressing positively. His remarks come with less than three weeks remaining before the July 9 deadline set by US President Trump for the "tariff suspension period."

"We hope to find a mutually satisfactory solution to ease the current trade tensions," Dombrovskis said at the press conference.

However, he also emphasized that if negotiations fail, the EU is prepared to take necessary measures to defend the core interests of EU enterprises and industries.

'Reciprocal Tariffs' Still Hypothetical, EU Remains Cautious

When asked if he accepted Trump's proposed 10% baseline tariff, Dombrovskis responded that it is a "speculative assumption that does not accurately reflect the current state of negotiations." Nonetheless, several unnamed diplomatic sources have disclosed that the European Commission has privately communicated to member states that a 10% tariff could become a reality and is likely the bottom line of the negotiations.

In fact, Trump hinted that this rate would be the standard for "most-favored treatment" in the trade agreement reached with the UK this May. Should the EU fail to reach an agreement, almost all exports to the US face the risk of tariffs as high as 50%.

EU Prepares Retaliation List with Clear Deterrent Intentions

To counter potential trade impacts, the EU has approved retaliatory tariffs on 21 billion euros (approximately $24.1 billion) worth of American goods. Affected goods include politically sensitive agricultural and manufacturing products such as soybeans, poultry, and motorcycles from Louisiana—the home state of US House Speaker Mike Johnson.

In addition to the current list, the EU has prepared an extended countermeasure list worth up to 95 billion euros, covering emblematic industrial items such as Boeing planes, American-made cars, and bourbon whiskey, designed to counter Trump's proposed "reciprocal tariffs" and potential automotive tariffs.

EU: Ready to Retaliate at Any Time

European Commission spokesperson Ole Gills warned earlier this month that if negotiations break down, existing and newly proposed countermeasures will take effect on July 14, or even earlier if necessary.

"The European Commission has consistently stated that it will resolutely protect the interests of workers, consumers, and industries in the region, using all necessary measures," he added in a statement.

It is noteworthy that US Secretary of Commerce Howard Lutnick recently stated that a trade agreement with the EU "might be the last one completed in the US negotiating queue." This indirectly illustrates the complexity of the current round of negotiations.

Risk Warning and DisclaimerThe market carries risks, and investment should be cautious. This article does not constitute personal investment advice and has not taken into account individual users' specific investment goals, financial situations, or needs. Users should consider whether any opinions, viewpoints, or conclusions in this article are suitable for their particular circumstances. Investing based on this is at one's own responsibility.

很赞哦!(6)

相关文章

- RaiseFX Trading Platform Review: Operating Normally

- Gold hits new highs, Chinese jewelry tops 800 yuan as consumers turn rational.

- Euro nears parity as Deutsche Bank and JPMorgan stay bearish.

- Gold falls below key support as bears dominate, bulls defend 50

- XPro Markets Broker Review:Regulated

- US dollar index hovers high as market eyes inflation data and Fed rate outlook.

- With the RBA decision nearing, the Australian dollar faces multiple macroeconomic influences.

- US dollar weakness boosts Australian dollar as markets eye RBA rate decision and US election.

- Saudi Arabia readies $40 billion venture fund for AI investment. Will it spark new growth?

- Gold sees largest weekly drop in three years, may hit $2,400 before safe

热门文章

- Asia Pacific Accounting fined 3 million yuan for Brilliance Group's fraud.

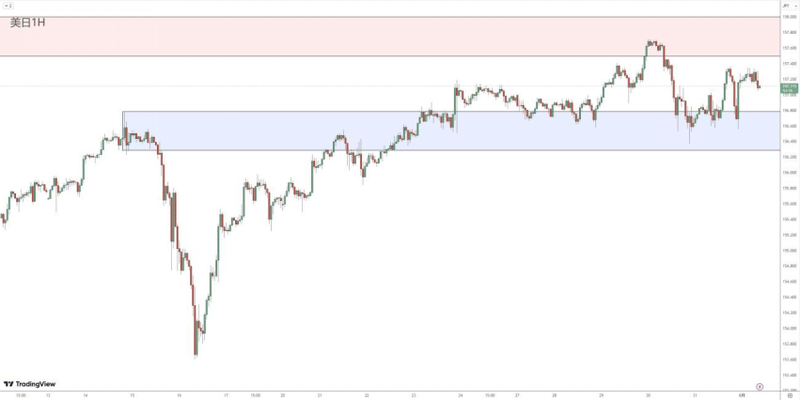

- Japanese yen appreciation impacts forex market as USD/JPY nears a critical level.

- The yen is capped by BOJ policies, with USD/JPY near key levels.

- Risk aversion boosts gold to a new high amid U.S. election disputes and Middle East conflicts.

站长推荐

HERO Trading Platform Review: High Risk (Suspected Scam)

The yuan hits a 4

USD strengthens against CAD as markets expect BoC’s dovish stance to boost its rise.

Asia's $6.4 trillion reserves shield against strong dollar impact and U.S. election risks.

Australasian Capital Pty Ltd’s Australian financial license is suspended; Hyphe gains BaF.

The yen is capped by BOJ policies, with USD/JPY near key levels.

Middle East conflict fuels risk aversion, pushing gold prices higher and increasing forex volatility

Gold reaches a new high, fueled by safe